retroactive capital gains tax increase

Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at.

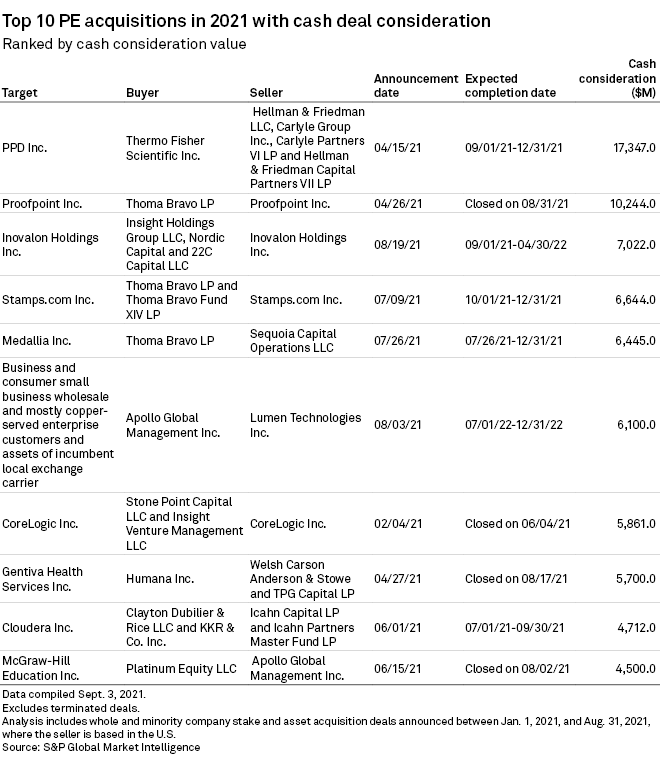

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Bidens Proposed Retroactive Capital Gains Tax Increase.

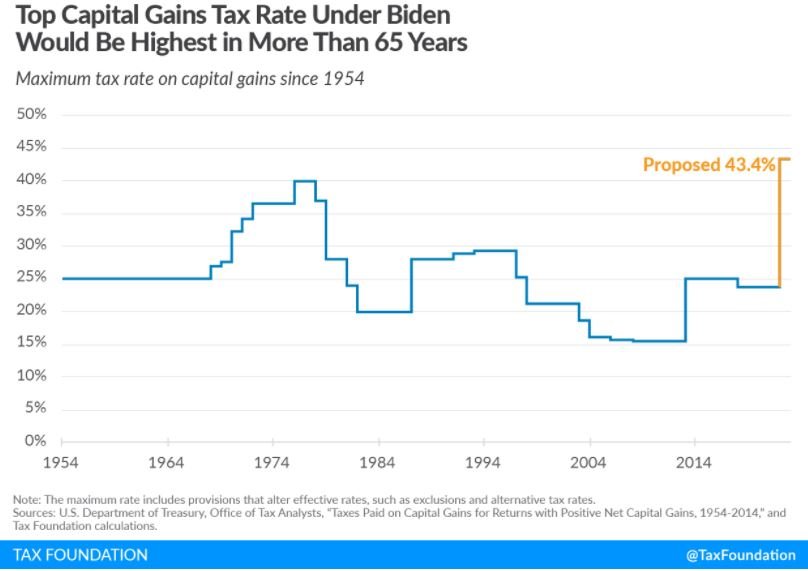

. The proposed capital gains rate hike may be retroactive to the date of announcement the. Top earners may pay up to 434 on long-term capital gains including the 38 Obamacare surcharge. The increase in revenue would come from the higher tax brackets thus forcing high-income taxpayers to shoulder additional tax liability.

The proposed budget would increase the taxes on capital gains for Americans earning more than 1 million to 434 which makes the rate the same as these individuals regular income tax rate completely eliminating the tax benefits of capital gains. It would be very surprising to see the capital gains rate go higher than 28. The bank said razor-thin majorities in the House and Senate would make a big increase difficult.

Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year. Reduced the maximum capital gains rate from 28. A Multimillion-Dollar Sale No.

Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan. The purpose of President Bidens proposed retroactive tax rates is presumably to prevent taxpayers from selling appreciated capital assets during the time period between the announcement of the proposed legislation. The proposed tax increase on capital gains may be applied to taxpayers with annualized realized gains over 1 million.

The proposed capital gains rate hike may be retroactive to the date of announcement the. Top earners may pay up to 434 on long-term capital gains including the 38 Obamacare surcharge. If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the Affordable Care Act.

In somewhat of a surprise however President Bidens budget calls for the. The Darusmonts had to pay an additional 2280 which for a family like. A Retroactive Tax Increase Biden wants to tax capital gains you made even before a bill passes.

Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. This change has and could cause more disruption and volatility to the market as shareholders panic and quickly sell.

This resulted in a 60 increase in the capital gains tax collected in 1986. Even if the capital gains increase is retroactive they would still save money because the capital gains would be based on a 37 marginal tax rate instead of 396. This plan was made to be retroactive in.

The Democrats proposed tax deduction for the rich puts the Vermont socialist and low. Signed 5 August 1997. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from 20 to 396.

The 1987 capital gains tax collections were slightly below 1985. As was widely anticipated President Bidens budget calls for some significant changes to the capital gains rules including a proposal to increase the top capital gains rate currently 20 to 396 before application of the 38 net investment income tax for income in excess of 1 million. In fact recent intelligence suggests many Democrats favor a rate increase as low as 42 percentage points which would result in a 242 rate before net investment income NII tax and a 28 rate inclusive of the 38 NII tax.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1. 7 rows Introduced 24 June 1997. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis.

Then in October President Gerald Ford signed the Tax Reform Act of 1976 which retroactively increased the minimum tax. But many were taken off guard by the May 2021 announcement that the increase would be implemented retroactively with a potential start date as early as April 2021. Top earners may pay up to 434 on long-term capital gains including the 38 Net Investment Income Tax.

How Do Capital Gains Taxes Work Who Owes Tax Rates And More

A Look At The American Families Plan Center For Agricultural Law And Taxation

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

What The Capital Gains Tax Means For Amazon Fba Sellers Perchhq

A Look At The American Families Plan Center For Agricultural Law And Taxation

What The Capital Gains Tax Means For Amazon Fba Sellers Perchhq

How Do Capital Gains Taxes Work Who Owes Tax Rates And More

What The Capital Gains Tax Means For Amazon Fba Sellers Perchhq

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Alabama Legislature Passes House Bills 82 And 231

Find Out Crypto Tax Rates For 2022 Tax Year 2021 In One Glance

Record Medline Buyout Is Just The Start As Wealthy Flee U S Tax Hike Crain S Chicago Business

Find Out Crypto Tax Rates For 2022 Tax Year 2021 In One Glance

Plenty Of Good News For U S Taxpayers This Independence Day

What The Capital Gains Tax Means For Amazon Fba Sellers Perchhq

How Do Capital Gains Taxes Work Who Owes Tax Rates And More

Find Out Crypto Tax Rates For 2022 Tax Year 2021 In One Glance