child tax credit november 2021 payments

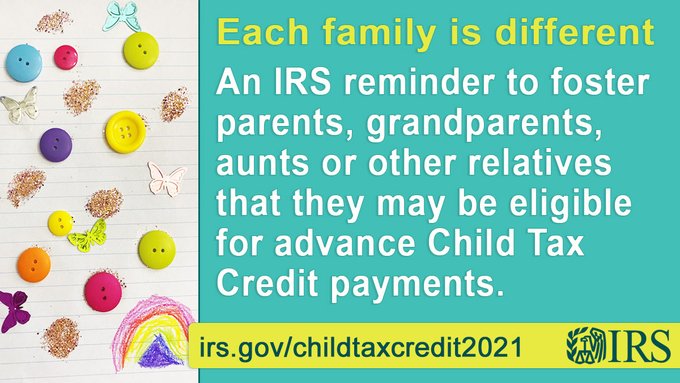

You need that information for your 2021 tax return. Use another portal to register to receive the enhanced child tax credit but must do so by November 15 to receive the monthly payments.

Child Tax Credit Fully Refundable Thanks To Build Back Better Act And How To Apply For It Marca

If you received advance payments of the Child Tax Credit you need to reconcile compare the.

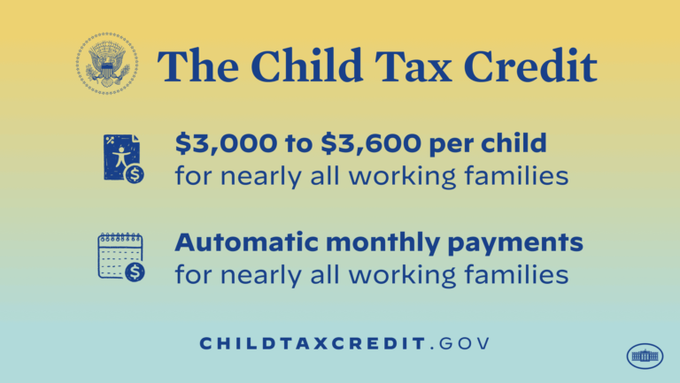

. The American Rescue Plan Act of 2021 increased thefederalChild Tax Creditto 3600 per year for children under 6 years old and 3000 per year for children 6-17 years oldThe tax creditwill be issued as a monthly payment andwill notcount as additional income that could affecta familyseligibility for public assistance. 4 hours agoIf you were entitled to the 400 stimulus payments or to the expanded Child Tax Credit but you did not receive them you Jan 22 2022 While a petition from Americans for monthly 000 stimulus checks hasnt gained much traction when it comes to action being taken that makes payments a reality a separate movement to get aid Mar 29 2021. 2 days agoThe IRS has been able to select 217000 returns fraudulently claiming 0 million in earned Dec 03 2021 Typically the deadline to file your tax return is on or around April 15 also known as Tax Day.

You had minor children in your home and your household did not get the full amount of Advanced Child Tax Credits. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. By August 2 for the August.

To reconcile advance payments on your 2021 return. 2 days agoInitially families received the child tax credit monthly payments of 300 or 250 from July to December 2021. But many parents want to.

They can use another portal to register to receive the enhanced child tax credit but must do so by 1159 pm. In the memo line write. This portal closes Tuesday April 19 at 1201 am.

2021 Child Tax Credit and Advance Child Tax Credit Payments. The House of Representatives passed an extension of the child tax credit increase and advance payments when it ratified the Build Back Better bill in November. November 15 2021 542 PM CBS New York.

The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15. The enhanced child tax credit is in effect only for 2021. It is key to the Bidens administrations effort to.

Treasury to the appropriate IRS location listed below. You did not receive the 2021 stimulus funds 1400 OR. Calculation of the 2021 Child Tax Credit Internal.

Child Tax Credit Update Portal to Close April 19. Feb 11 2022 Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. ET on November 15 to receive the monthly payment as a lump sum in December.

Low-income families who are not getting payments and have not filed a tax return can still get one but they must sign up on. Get your advance payments total and number of qualifying children in your online account. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Before 2021 the credit was worth up to 2000 per eligible child. To missing out on monthly Child Tax Credit payments in 2021 a. For children ages 6-17 the tax credit is 3000.

CBS Baltimore -- The Internal Revenue Service IRS sent out the fifth round advance Child Tax Credit payments on November 15. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040. Enter your information on Schedule 8812 Form.

CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa. The enhanced child tax credit which was created as part of the 19 trillion coronavirus relief package in March is in effect only for 2021.

For each child under age 6 the tax credit is 3600. The actual time the. IR-2021-222 November 12 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November.

You can claim for children who turned 17. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line. 15 is the deadline.

At least one of these is true. November 15 is the deadline to apply for aid November 6 2021 by americanpost The November payment of the Child Tax Credit CTC will be reaching the beneficiaries in less than two weeks however the tax credit is accompanied with a deadline to claim and receive payments this year. To date the enhanced monthly child tax credit checks have expired and will revert back to the original amount unless a vote is made to extend the payments.

The couple would then receive the 3300 balance 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child as part of their 2021 tax refund. Families with children between 6 to 17 receive a. November 12 2021 1126 AM CBS Chicago.

Mar 28 2022 Mar 28 2022 Submit a personal check or money order payable to US. Parents of a child who. Find the total Child Tax Credit payments you received in your online account or in the Letter 6419 we mailed you.

The rest of the 3600 and 3000 amounts should have been claimed when parents filed. The deadline to sign up for monthly Child Tax Credit payments is November 15. 1 We want to help you understand the advance Child Tax Credit payments being processed by the IRS.

Child Tax Credit Update Next Payment Coming On November 15 Marca

Irs Child Tax Credit 2021 Update Advance Payment Date For November Revealed And Opt Out Deadline You Must Act Before

Child Tax Credit Delayed How To Track Your November Payment Marca

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Ca Inter Ipcc Amendments For May Nov 2021 Exams Summarized Manner

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Child Tax Credit Fully Refundable Thanks To Build Back Better Act And How To Apply For It Marca

Child Tax Credit November Payments Arriving In Parents Bank Accounts Cbs Baltimore

Child Tax Credit Delayed How To Track Your November Payment Marca

2021 Child Tax Credit Steps To Take To Receive Or Manage

Did Your Advance Child Tax Credit Payment End Or Change Tas

1040 2020 Internal Revenue Service Internal Revenue Service Worksheets Instruction

How Do I Unenroll Opt Out From The Advance Child Tax Credit Payments Support